Low-Interest Flexible Loans

Providing access to capital to ensure a constant and growing food supply

The Microloan Program

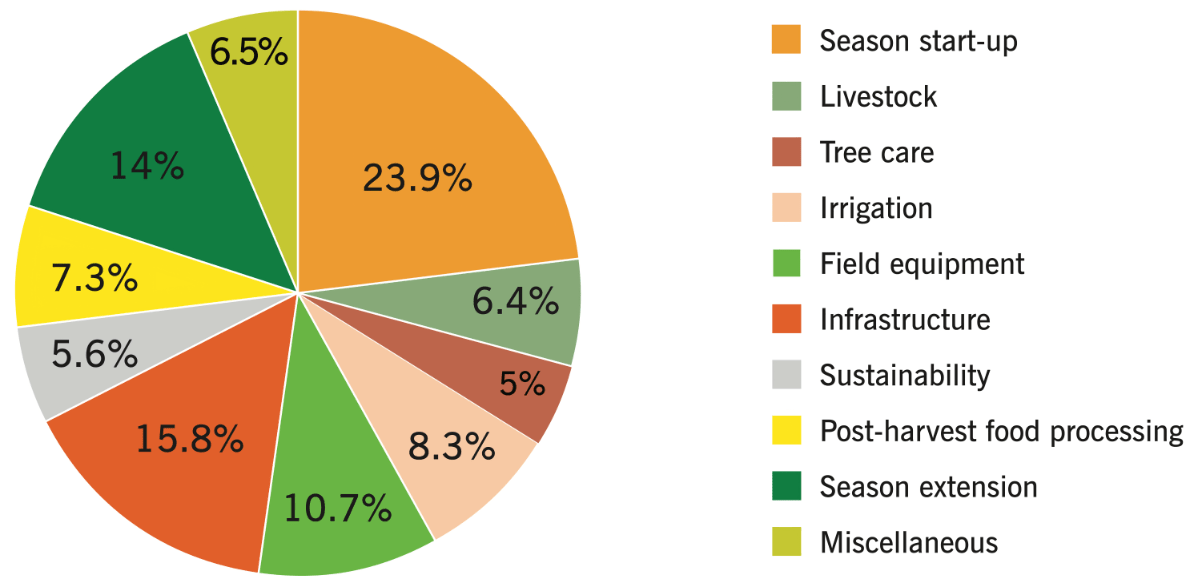

Farmers often have limited resources or lack access to capital, which can impact the sustainability of their business or their capacity to grow. Our Microloan Program awards low-interest flexible loans, which fund projects that have a significant, positive impact on many of our vendors’ businesses, as well as the quality and quantity of the products brought to the Market. The Microloan Program helps vendors defray seasonal operating expenses, improve infrastructure, extend the growing season, and much more. Access to capital ensures that farmers and ranchers can provide a constant and growing food supply to Santa Fe and the region.

Access to credit can be a stumbling block for many small businesses, and farmers are no exception. Working in partnership with Guadalupe Credit Union for the past five years, the Institute’s Microloan Program facilitates low interest loans for farmers who might otherwise have difficulty accessing credit.

The Institute wants the loan experience to be successful for our farmers and ranchers. Through the partnership with Guadalupe Credit Union, now in its fifth year, borrowers receive financial coaching and assistance with the application. This customer service is available in English and in Spanish. All Market vendors have equal access to the Microloan Program regardless of gender, age (provided that the applicant is 18 years or older), ethnicity, or citizenship status.

The Impact

The main reason I got a microloan was to build credit, and that has been very helpful. If you pay on time, you can build your credit.

Female farmers and producers comprise more than 50% of the vendors at the Santa Fe Farmers’ Market. Research shows that women farmers face gender discrimination when trying to access Federal agricultural funding programs and traditional bank loans. The Institute is pleased to report that 50% of approved loans went to women farmers. One farmer said that, when she faced a “crippling” business expense, she was grateful for the microloan which was at an interest rate three times lower than if she would have had to finance the repair on credit cards.

I heard of a program through the USDA which provides some funding to farmers for infrastructure improvement, but what makes it tricky for some farmers is it is a reimbursement grant, so they don’t give you the money up front. Utilizing the Institute’s Microloan Program enabled us to get started on these projects and get reimbursed later.

Success by the Numbers

-

In 2022, six loans were extended keeping in pace with 2021.

-

Microloans totaling $69,170 were granted; a 73% increase over the previous year.

-

Since 2008, 379 loans were granted to 105 borrowers for a total disbursement of $871,760.

-

Over the course of the program, the maximum loan amount has increased from $3,500 to $20,000.